Technical Bounce Strategy

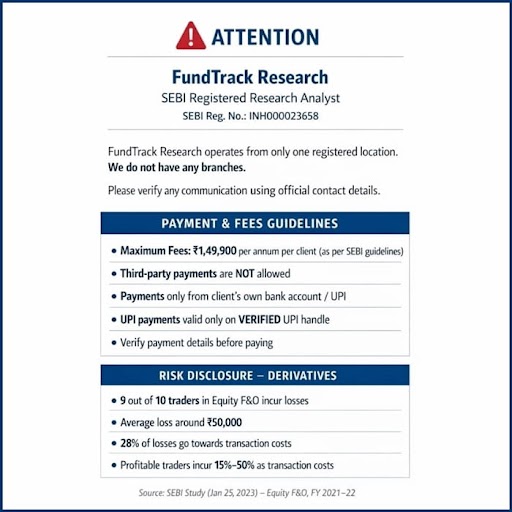

At FundTrack Research (SEBI Reg. No. INH000023658), this strategy is designed to help market participants understand potential swing opportunities using price action, volume behaviour, and technical indicators, without any assurance of returns

- The Technical Bounce Swing Trading Strategy focuses on identifying short-to-medium term price movements in fundamentally sound stocks that are showing signs of a technical rebound from key support levels.

- Strategy: Mid-cap stocks with strong growth potential.

- Deliverables: 20 stock recommendations each quarter.

- Quarterly Fee: ₹25,000 or Till total Delivery of Recommendation

Key Features of the Strategy

- Equity-focused swing trading approach

- Based on technical analysis, not speculation

- Uses price structure, trend analysis, and volume confirmation

- Clearly defined entry, target, and risk levels (indicative)

- Designed for traders who prefer non-intraday positions

Technical Parameters Considered

Our research process may include analysis of:

- Support and resistance zones

- Moving averages (e.g., 20 EMA, 50 EMA, 200 EMA)

- Relative Strength Index (RSI) for momentum assessment

- Volume patterns to validate price action

- Broader market and sectoral trend alignment

All parameters are used for research interpretation only and do not guarantee price movement.

Who Is This Strategy Suitable For?

This swing trading research is suitable for individuals who:

- Understand basic stock market concepts

- Are comfortable holding positions for multiple days

- Can manage market risk and volatility

- Prefer research-backed setups over random tips

- Make independent investment decisions

Research Deliverables

Subscribers to this research service may receive:

- Identified equity stocks showing potential technical bounce setups

- Indicative entry range, stop-loss level, and target zone

- Market context and technical reasoning behind the setup

- Periodic updates based on market movement

All research is shared via email or messaging platforms during market hours.

Important Risk Disclosure

Risk Disclosure:

Investments in securities markets are subject to market risks. Swing trading involves exposure to price volatility and gaps.

Past performance of any strategy or stock is not indicative of future performance. FundTrack Research does not provide any assurance or guarantee of returns.

The research shared is purely informational and educational in nature and should not be considered as investment advice. Clients are advised to assess their risk appetite and consult a qualified financial advisor before taking any trading or investment decisions.

Why FundTrack Research?

- SEBI Registered Research Analyst (INH000023658)

- Transparent and regulation-compliant research framework

- No profit sharing or performance-based fees

- Focus on disciplined analysis and risk awareness

- Client-first communication and support