Equity Basket

At FundTrack Research (SEBI Reg. No. INH000023658), the Equity Basket is designed to help investors study diversified equity opportunities through disciplined analysis, without any assurance or guarantee of returns.

Overview

The Equity Basket is a research-driven approach that groups selected equity stocks into a structured basket based on market trend, sectoral strength, and technical–fundamental alignment.

What is an Equity Basket?

An Equity Basket is a collection of carefully researched stocks selected using predefined criteria rather than isolated stock selection.

The basket approach aims to:

- Reduce concentration on a single stock

- Provide diversified exposure across sectors or themes

- Offer a structured framework for tracking equity performance

Key Features of the Equity Basket

- Research-based equity stock selection

- Diversified basket approach instead of single-stock dependency

- Combination of technical structure and fundamental filters

- Defined research rationale for each stock

- Periodic review based on market conditions

- Suitable for positional and medium-term holding perspective

Research Methodology

The Equity Basket research may involve analysis of:

- Overall market trend and index behavior

- Sectoral strength and rotation

- Stock-specific price action and trend structure

- Volume behavior and relative strength

- Fundamental stability indicators (where applicable)

All stocks included in the basket are selected strictly for research and educational purposes. Market outcomes may vary.

Basket Composition

Depending on market conditions, the Equity Basket may include:

- Large-cap, mid-cap, or select small-cap stocks

- Sector-focused or theme-based baskets

- Momentum or trend-aligned equity setups

The number of stocks and composition of the basket may change based on research reviews and market dynamics.

Who Is This Suitable For?

The Equity Basket research is suitable for individuals who:

- Prefer a structured equity research approach

- Understand equity market risks and volatility

- Seek diversification over single-stock exposure

- Make independent investment decisions

- Are comfortable with short- to medium-term holding periods

Research Deliverables

Subscribers may receive:

- Equity basket composition with research rationale

- Indicative entry range and risk considerations

- Periodic updates or revisions to the basket

- Market and sectoral commentary related to the basket

All research communication is shared via email and messaging platforms during market hours.

Risk Disclosure

Risk Disclosure:

Investments in equity markets are subject to market risks. Stock prices may fluctuate due to market conditions, economic factors, and company-specific developments.

Past performance of any equity or strategy is not indicative of future results. FundTrack Research does not assure or guarantee any returns.

The research shared is purely informational and educational in nature and should not be considered as investment advice.

Why FundTrack Research?

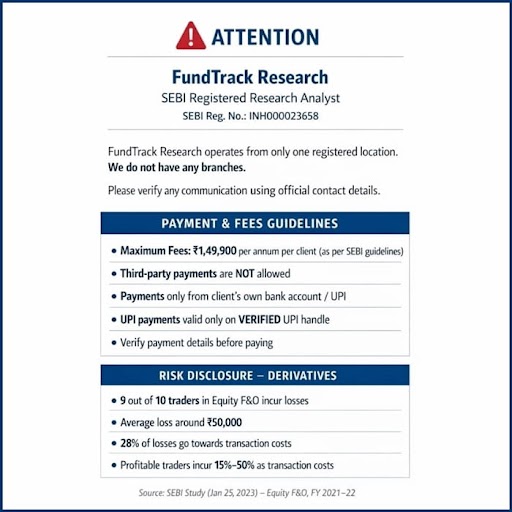

- SEBI Registered Research Analyst (INH000023658)

- Transparent and compliance-driven research process

- No guaranteed returns or profit-sharing model

- Focus on disciplined analysis and investor awareness

- Clear communication and risk disclosures

Deliverables:15 high-potential stock recommendations each quarter.

Quarterly Fee: ₹25,000 or Till total Delivery of Recommendation

This plan suits investors who are comfortable with volatility and aiming for outsized returns over shorter to longer timeframes based on recommendation