Derivatives Basket

At FundTrack Research (SEBI Reg. No. INH000023658), the Derivatives Basket is designed to help market participants understand and evaluate potential opportunities in options and futures through a diversified, rule-based research approach—without any assurance of returns.

Overview

The Derivatives Basket is a research-based framework that groups multiple derivatives trade ideas into a structured basket based on prevailing market conditions, volatility environment, and technical structure.

What is a Derivatives Basket?

A Derivatives Basket refers to a collection of derivative trade ideas (index options, stock options, and/or futures) that are selected using predefined technical and volatility parameters.

Instead of relying on a single trade, the basket approach aims to distribute exposure across multiple setups, helping market participants manage concentration risk while studying broader market behaviour.

Key Characteristics of the Derivatives Basket

- Research-based derivatives trade identification

- Basket approach instead of isolated trades

- Exposure across index options, stock options and commodity options, and futures in stock and commodity

- Technical and volatility-driven framework

- Indicative entry, exit, and risk levels

- No discretionary or impulsive trade selection

Research Methodology

The Derivatives Basket research may involve analysis of:

- Market trend and structure (index & sector level)

- Volatility indicators (India VIX, implied volatility trends)

- Option chain data (OI buildup, PCR interpretation)

- Price action and breakout / mean-reversion patterns

- Time decay and risk parameters in options

All analysis is performed strictly for research and educational purposes and does not guarantee market outcomes

Basket Composition

Depending on market conditions, a derivatives basket may include:

- Index option strategies (directional or range-based)

- Stock option setups with defined technical structure

- Futures-based positional or short-term trade ideas

The basket structure and number of instruments may vary based on volatility, liquidity, and market participation.

Who Should Consider This Research?

This research service is suitable for individuals who:

- Are comfortable with volatility and leverage-related risks

- Prefer structured and rule-based research frameworks

- Can independently manage capital and execution

- Understand that derivatives carry higher risk than cash equities

Research Deliverables

Subscribers may receive:

- Periodic derivatives basket research updates

- Trade structure overview with indicative levels

- Risk context and volatility outlook

- Market commentary related to the basket performance

Research updates are shared via email and messaging platforms during market hours.

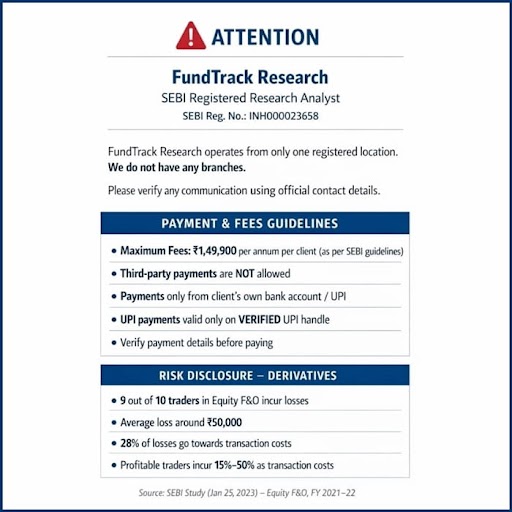

Risk Disclosure

Derivatives trading involves substantial risk and may not be suitable for all investors. Options and futures are subject to market volatility, leverage, and time decay risks.

Past performance of any strategy or research output does not guarantee future results. FundTrack Research does not provide any assurance or guarantee of returns.

The research shared is for informational and educational purposes only and should not be construed as investment advice or solicitation to trade.

Why FundTrack Research?

- SEBI Registered Research Analyst (INH000023658)

- Transparent, rule-based research methodology

- No assured returns or profit-sharing model

- Clear risk disclosures and compliance-driven communication

- Focus on investor awareness and discipline

For active traders looking to capitalize on intraday and options volatility.

- Strategy: Stock options, index options, and futures recommendations.

- Deliverables: 110–220 intraday and BTST trade ideas monthly, technical support & market outlooks.

- Required Capital: Minimum investment criteria apply.

Half Yearly Fee: ₹ 99,900/-only